How Payroll Period Configuration Matches Your Pay Cycles

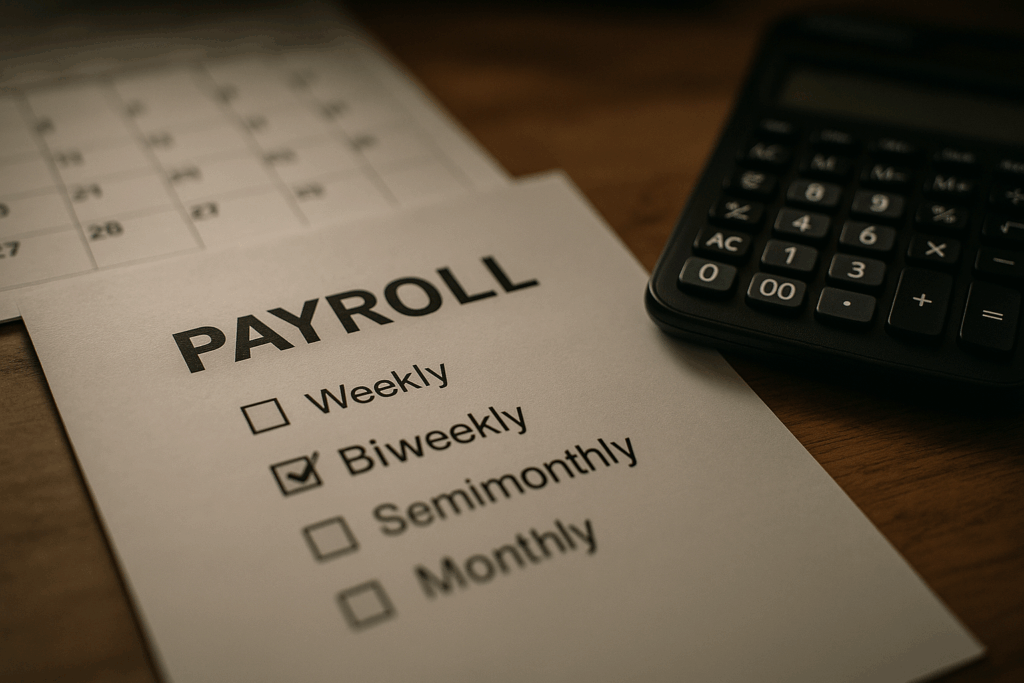

payroll period configuration is a crucial aspect of effective payroll management, influencing how often employees are paid and how payroll processes are managed within an organization. Understanding this configuration involves knowing the intervals that determine the timing of payments, which can vary significantly between companies. These configurations can be set up on a weekly, biweekly, semimonthly, or monthly basis, offering flexibility to meet diverse business requirements and employee preferences. Furthermore, payroll period configuration must align with other critical factors such as tax withholding schedules, employee work hours, and benefits accrual. Accurate configuration ensures that all employees receive their compensation promptly and correctly, minimizing the potential for errors or discrepancies. Additionally, a well-defined payroll period allows for better financial planning and can aid in maintaining compliance with labor laws and regulations related to payment processes. By comprehensively understanding payroll period configuration, businesses can create a streamlined system that enhances operational efficiency and employee satisfaction.

New in this topic: The Advantage of Clear Pricing Without Hidden Upgrade Costs.

Types of Pay Cycles

Pay cycles refer to the specific intervals at which employees receive their wages, and they play a vital role in the overall payroll period configuration of a company. The most common types of pay cycles include weekly, biweekly, semimonthly, and monthly pay periods. Weekly pay cycles offer the highest frequency, allowing employees to receive their earnings every week. This method is often favored in industries where workers rely on consistent, short-term cash flow, such as retail and hospitality. Employers must be diligent in managing these pay cycles to ensure that all hours worked are accurately accounted for within each week, thereby minimizing potential discrepancies.

Biweekly pay cycles are another popular option, consisting of payments made every two weeks. This cycle provides an ideal balance for both employees and employers, as it results in 26 pay periods each year. It simplifies the payroll process while still offering employees a relatively frequent payout schedule. However, businesses should prepare for the months in which employees receive an extra paycheck, which can disrupt cash flow if not properly budgeted for.

Semimonthly pay cycles, which consist of two pay periods each month, are typically scheduled for the 15th and the last day of the month. This configuration aligns well with monthly billing cycles for many services, making it a convenient choice for both employers and employees. It is essential for payroll period configuration in semimonthly cycles to ensure that salary calculations are clearly understood, as the variation in the number of workdays can complicate biweekly equivalences.

Monthly pay cycles, on the other hand, provide the least frequent payouts, with employees receiving their wages once a month. This arrangement is beneficial for employers who want to reduce payroll processing time and administrative costs. However, it may require employees to exercise more budgeting skills to manage their finances between paydays. Regardless of the chosen cycle, aligning payroll period configuration with business needs, employee expectations, and industry standards is critical to effective payroll management, requiring ongoing assessment and adjustments as necessary.

Aligning Payroll Periods with Business Needs

Aligning payroll periods with business needs is essential for creating an effective payroll system that meets both organizational goals and employee expectations. For a business, the choice of payroll period is not merely a routine decision; it can significantly impact cash flow, operational efficiency, and employee satisfaction. To achieve this alignment, companies must consider factors such as employee demographics, industry standards, cash flow requirements, and compliance regulations. For instance, a company in the retail or hospitality sector, where employees work varying hours, may benefit from a weekly or biweekly payroll structure. This frequency allows workers to receive their earnings promptly, supporting their cash flow needs and reducing financial stress.

On the other hand, organizations with a stable workforce and a predictable workload may opt for semimonthly or monthly payroll cycles. These longer intervals can simplify payroll processing and reduce administrative burdens, allowing HR departments to focus on strategic initiatives rather than repetitive tasks. Nonetheless, businesses must ensure that their payroll period configuration accommodates any irregularities in employee hours, particularly with salaried positions where calculations may differ based on actual hours worked.

Furthermore, aligning payroll periods with business needs necessitates continuous communication and flexibility. Regularly gathering feedback from employees can reveal preferences and pain points related to payment frequency and methods. For instance, some employees might prefer quicker access to their wages via more frequent pay periods, while others might appreciate the simplicity of monthly payouts, especially if they are accustomed to monthly budgeting cycles. By being responsive to these insights, organizations can adjust their payroll configurations to foster a more supportive work environment.

Additionally, businesses must also consider the technological aspects of payroll period configuration. Leveraging modern payroll software can significantly streamline the process of aligning payroll periods with business needs. Advanced payroll systems can accommodate various pay cycles and facilitate accurate calculations, ensuring that the correct amounts are dispersed on time. This capability not only enhances employee satisfaction but can also minimize potential legal issues stemming from payroll errors, making compliance easier to achieve.

The alignment of payroll periods with business needs is a multifaceted process that requires careful consideration of various factors, ranging from industry practices to employee preferences. By focusing on these critical elements, organizations can create a payroll system that is both efficient and empowering, ultimately contributing to a healthier work culture and improved employee retention.

Benefits of Proper Configuration

Implementing proper payroll period configuration offers numerous benefits that can enhance both operational efficiency and employee satisfaction. When payroll periods are configured accurately, organizations can ensure that employees are paid on time and that their compensation reflects their work accurately. This punctuality is vital for maintaining trust and transparency between employers and employees. Moreover, a reliable payroll system mitigates the risk of errors that can lead to disputes or dissatisfaction among staff. Pay frequency is often tied to employee well-being; therefore, having a streamlined payroll period configuration can improve morale and reduce stress associated with financial uncertainties.

Another significant advantage of proper payroll period configuration is increased compliance with labor laws and regulations. Employers who configure their payroll periods correctly are more likely to adhere to local, state, and federal laws governing wage payments. This adherence can minimize the risk of costly penalties or legal disputes that can arise from delayed or inaccurate payments. Furthermore, a well-structured payroll system aids in the timely processing of tax withholdings, which can reduce the employer’s liability at the end of the fiscal year.

Operationally, an optimal payroll period configuration allows businesses to better manage cash flow. By forecasting payroll expenses effectively, companies can allocate funds more strategically, ensuring that sufficient resources are available to meet payroll obligations without disrupting other financial commitments. This approach enables organizations to maintain financial stability, particularly during peak business periods or unforeseen economic challenges. Additionally, the ease of processing payroll within a well-defined period reduces the administrative burden on HR departments, allowing them to reallocate their time and resources toward more strategic initiatives.

From an employee perspective, a proper payroll period configuration aligns with their personal budgeting and financial planning needs. Regular and predictable pay periods enable employees to manage their expenses more effectively, supporting their overall financial health. Additionally, options like direct deposit can enhance the convenience of receiving wages, further improving the employee experience. Overall, a thoughtful approach to payroll period configuration can yield substantial benefits, creating a more harmonious relationship between employers and employees while reinforcing a company’s commitment to efficiency and compliance.

Common Challenges and Solutions

While establishing an effective payroll period configuration provides significant advantages, organizations may encounter several challenges that can complicate the process. One common issue is the resistance to change from employees accustomed to existing pay schedules. Transitioning to a new payroll cycle can lead to confusion and dissatisfaction, particularly if employees are not adequately informed about how changes will affect their compensation or cash flow. To mitigate this challenge, employers should prioritize transparent communication, clearly explaining the reasons for the shift and how it benefits both the organization and its employees. Offering educational resources and support during the transition can further alleviate concerns and facilitate a smoother adoption of the new configuration.

Another challenge arises from the complexity of accurately calculating payroll when switching between different pay cycles. Organizations must ensure that payroll systems are capable of handling the intricacies involved in various configurations, particularly for employees working irregular hours or under different contracts. This complexity can lead to errors in payment calculations, which may inadvertently impact employee trust and satisfaction. Implementing robust payroll software that can automate calculations and generate accurate pay statements is essential in overcoming this challenge. Regular audits and checks can also help to identify discrepancies early in the process, ensuring that employees receive the correct amounts on time.

Compliance with local and federal laws presents another layer of complexity in payroll period configuration. Employers must be aware of regulations governing pay periods, tax withholding, and overtime, which can vary widely depending on jurisdiction and industry. Non-compliance can result in severe penalties and legal repercussions. One solution is to work with legal or HR professionals who specialize in labor laws to ensure payroll practices are up to date and compliant with the latest regulations. Additionally, staying informed about potential changes in legislation can position a company to adapt proactively instead of reactively, reducing the likelihood of errors.

Furthermore, fluctuating cash flow can pose difficulties in maintaining a stable payroll period configuration. Companies may find it challenging to manage payroll obligations during periods of low revenue or unexpected financial strain. A strategic approach to budgeting that incorporates cash flow forecasting can help organizations allocate sufficient funds for payroll expenses. This approach may also include establishing financial reserves or exploring funding options to cover payroll during lean periods. By proactively addressing cash flow issues, businesses can sustain their payroll commitments without compromising employee satisfaction.

Lastly, technology integration is often a hurdle when implementing or changing payroll systems. Not all payroll software solutions are equally equipped to handle diverse payroll period configurations, which may lead to inefficiencies and user frustration. To overcome this, organizations should invest in reputable payroll systems that offer customization and scalability to accommodate different pay cycles. Providing training for HR and finance teams on utilizing these tools effectively is also crucial, as it equips staff to better manage payroll processes and troubleshoot any issues that may arise.